Thinking about enrolling in summer classes but unsure how to cover the cost? You’re not alone. Many college students take courses during the summer to catch up, get ahead, or reduce their academic-year workload, but tuition, textbooks, and living expenses don’t take a vacation.

The good news? You don’t have to pay for it all out of pocket. Whether you’re trying to finish your degree faster or retake a challenging class, there are smart and flexible ways to get money for summer classes. From financial aid for summer classes to student loans for summer classes, this guide will walk you through the best options so you can focus on your studies, not your wallet.

Why Summer Classes Are a Smart Move?

Summer classes aren’t just a way to stay busy, they’re a strategic opportunity to get ahead academically and financially. Whether you’re trying to fast-track your degree or ease your course load later, summer sessions offer major advantages.

Stay on Track or Get Ahead

Many students choose summer classes to:

- Graduate sooner by earning extra credit

- Retake tough courses without the pressure of a full semester

- Lighten a future course load, making the fall or spring less intense

- Explore new interests like electives or a potential minor

Taking even one or two courses during the summer can help you build momentum and reduce the overall time to graduation.

Save Money in the Long Run

One of the hidden perks of summer classes is their cost structure. Many colleges charge tuition per credit hour during the summer term, which means:

- You only pay for what you take

- No full-time enrollment requirements to access courses

- Lower overall costs compared to traditional semesters (especially at community colleges)

In short, summer classes can be a cost-effective way to stay on track without breaking the bank.

Start With FAFSA: Your Key to Summer Financial Aid

Before doing anything else, fill out the Free Application for Federal Student Aid (FAFSA). This is your golden ticket to unlock financial aid for summer classes, including grants, work-study, and federal student loans, and summer semester funding.

Understand Summer School Financial Aid Eligibility

Each school handles summer financial aid differently. Some treat it as part of the previous academic year, while others count it toward the upcoming year.

Pro Tip:

Check with your school’s financial aid office to find out how summer is categorized and which FAFSA year to complete.

Pell Grant for Summer Terms

You may qualify for year-round Pell, allowing you to receive up to 150% of your annual award.

Example:

If you normally receive $3,000, you could get an extra $1,500 for the summer if enrolled at least part-time.

Remember, Pell Grants don’t need to be repaid, making them one of the best ways to get money for summer classes.

Explore Federal Student Loans for the Summer Semester

If grants and scholarships don’t cover everything, federal student loans for the summer semester can fill in the gaps.

Direct Subsidized Loans

- For undergrads with financial need

- The government pays the interest while you’re in school

- Lower lifetime loan limits, but the lowest cost option

Direct Unsubsidized Loans

- Available regardless of financial need

- Interest accrues while in school

- Higher loan limits than subsidized loans

Parent PLUS Loans

Parents of dependent undergrads can borrow to cover any remaining summer session student loans not met by other aid. These require a credit check and come with higher interest rates, but offer flexible repayment.

Tip: Ask your financial aid office if you can request a borrower-based award year, which may allow you to apply unused federal aid toward summer.

Private Student Loans: Fast, Flexible Summer Financing

If federal options fall short, consider private student loans for summer classes from reputable lenders. They often offer quick approvals, no fees, and flexible repayment.

Top Private Lenders for Summer Classes

Here are a few standout lenders offering student loans for summer classes:

College Ave

- Quick online application (3 minutes)

- Choose your repayment plan and term

- Covers up to 100% of school-certified costs

Earnest

- Prequalify with no credit impact

- Skip one payment per year

- No origination or late fees

ELFI

- Personalized service with a dedicated loan advisor

- Highly rated customer support

- Competitive rates with flexible repayment options

Scholarships and Grants for Summer Students

Scholarships aren’t just for the fall and spring. Although fewer are available in summer, they’re still worth seeking out.

How to Find Summer-Specific Scholarships

- Search your school’s scholarship database

- Ask if current scholarships can be split into three terms

- Use scholarship platforms

Pro Tip: Appeal for More Support

Contact scholarship organizations to explain your summer enrollment. They may be willing to increase your award or split your current aid across three semesters.

Institutional Aid and Work-Study

Many schools offer student aid for summer school, including:

- Need-based grants

- Departmental scholarships

- Summer work-study positions

However, summer school financial aid eligibility often varies, so:

- Apply early (start planning in February or March)

- Ask if your school disburses institutional aid for summer

- Inquire about work-study availability during summer break

How to Apply for Student Loans for Summer Classes

Federal Loans

- Submit the FAFSA as early as possible

- Confirm with your school which academic year to use

- Accept grants/scholarships before loans

- Choose subsidized loans before unsubsidized

Private Loans

- Compare lenders (interest rates, terms, fees)

- Apply online—many offer instant decisions

- Provide necessary documents (ID, school info, income/tax info)

- Wait for your school to certify the loan

- Accept and sign your loan agreement

Tip: Apply 4–6 weeks before classes start to ensure funds are ready on time.

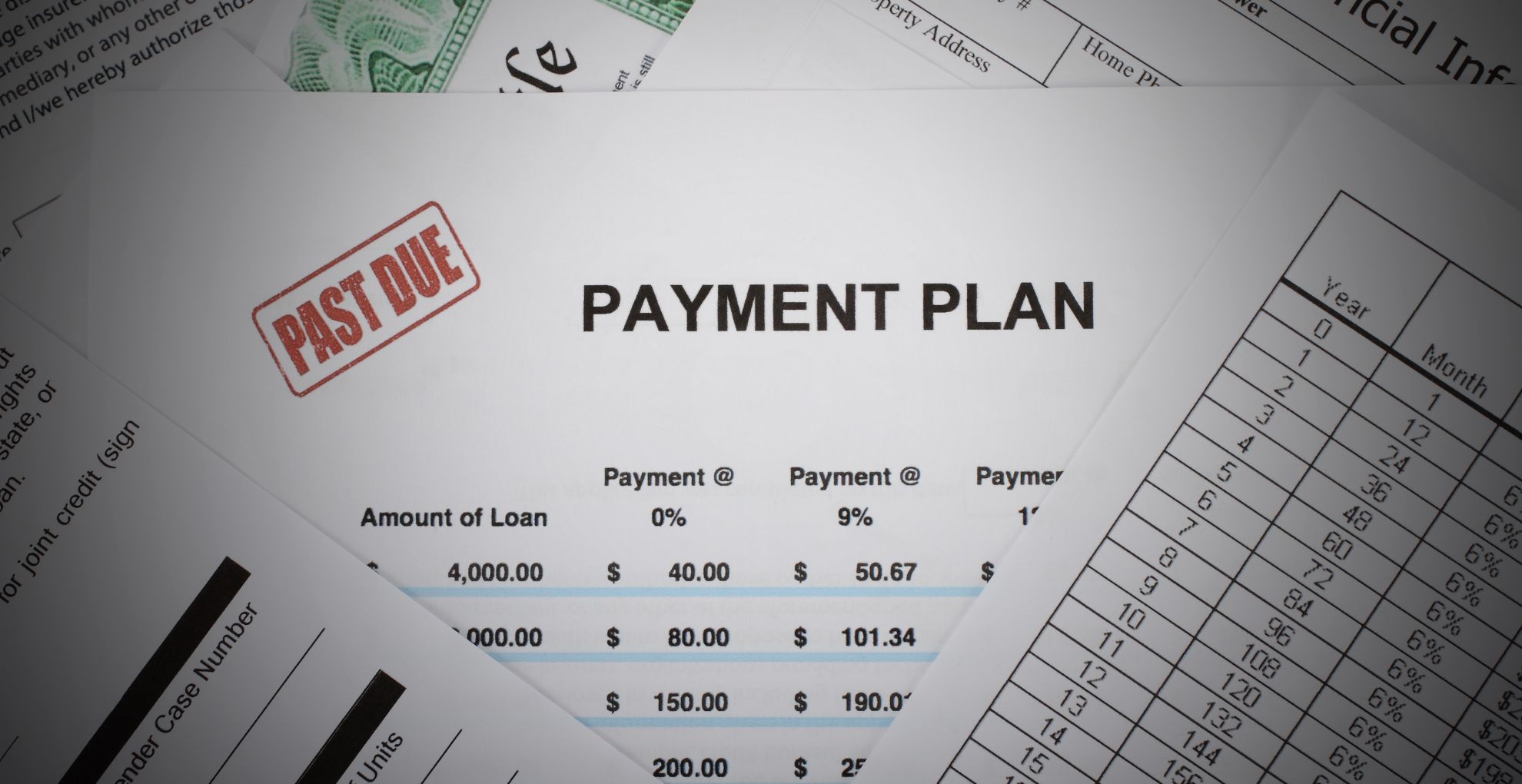

Repaying Your Summer Student Loans

Repayment works just like during the regular year.

For Federal Loans:

- Typically enter repayment 6 months after leaving school

- Choose from several repayment plans (including income-driven)

For Private Loans:

- May offer full deferment, interest-only, or flat-rate payments ($25/month)

- Some lenders allow extra flexibility, like skipped payments or refinancing later

Smart Strategy:

Make small payments while in school if possible—this reduces long-term interest costs.

FAQs About Student Loans for Summer Classes

Can I use student loans for all summer classes?

Yes, if your classes are part of an accredited degree program and your school confirms your enrollment status (usually at least half-time).

Are summer student loans different from regular semester loans?

Not necessarily. Federal student loans for the summer semester are drawn from the same pool of aid as fall and spring, but timing and FAFSA filing may differ.

What happens if I drop a summer class?

Your financial aid could be reduced or revoked. Always speak with a financial aid counselor before making schedule changes.

Do I need a cosigner for private loans?

Most students do. Having a creditworthy cosigner improves your chances of approval and helps secure better interest rates.

Final Thoughts

Finding money for summer classes might seem stressful at first, but it’s entirely doable with the right plan. Whether you’re tapping into financial aid for summer classes, applying for federal student loans for summer semester, or comparing private student loans for summer classes, there’s a solution that fits your needs and timeline.

Start by submitting the FAFSA, explore all grant and scholarship options, and don’t hesitate to talk with your school’s financial aid office; they’re there to help.

Summer might be short, but the impact of smart academic planning and smart financial choices can last a lifetime.